Now here comes the most excruciating part of the BIR business registration: filling out the forms. 😱. Don’t worry, I got you covered. 😉 Been there, done that. 🤣

This is part 5 of The Ultimate Guide to Starting a Business in the Philippines series.

Table of Contents:

- BIR Form 1901: Application For Registration

- Proof of Address

- Valid IDs

- Application For Authority to Print Receipts and Invoices

- Registration of Book Accounts

- BIR Form 1905: Application for Registration Information Update/Correction/Cancellation

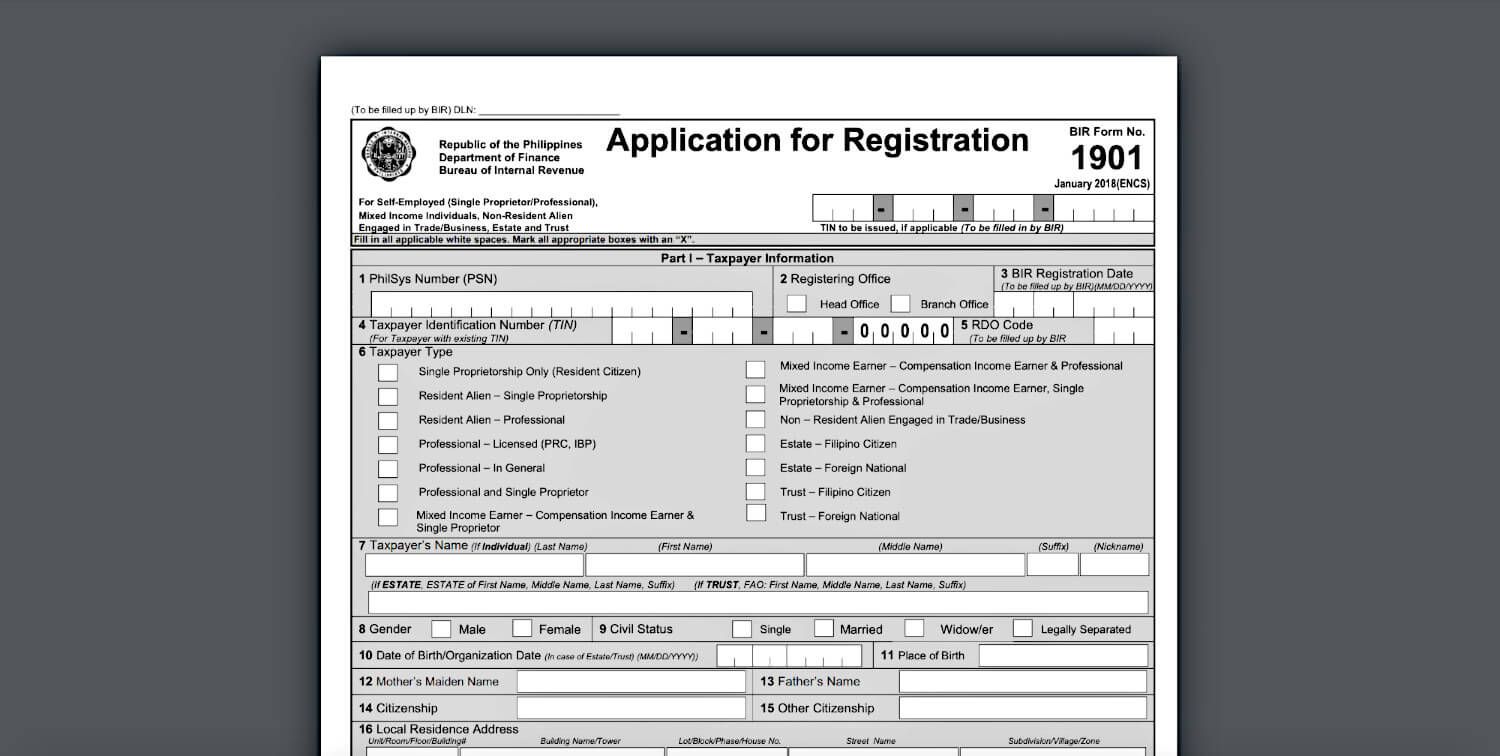

BIR Form 1901: Application for Registration

Go ahead and download the BIR Form 1901 from the BIR website. If you downloaded it from somewhere else take note that it should be the January 2018 version. You can find this on the upper right corner of the first page just below the 1901 label.

Most of the fields are pretty straighforward except the following:

Part 1 - Taxpayer Information

Field 1. PhilSys number - If at the time of reading the National ID has not yet been distributed, you may leave this blank.

Field 2. Registering Office - Select Head Office as you are registering the business for the first time.

Field 6. Taxpayer Type - If you are not employed, select Single Proprietorship Only. If you are currently employed, select Mixed Income Earner - Compensation Income Earner & Single Proprietor.

Field 23. Are you availing of the 8% income tax rate option in lieu of Graduated Rates? Yes or No - explained below

VAT vs NON-VAT

If the projected annual income is below 3 million Pesos, you are not required to register for VAT. If you are NON-VAT, the answer to the question “Are you availing of the 8% income tax rate option in lieu of Graduated Rates?” should be Yes. If VAT, the answer should be No.

More reading: 8 Benefits of 8% Gross Income Tax Rate

Part 3 - Authorized Representative

If you opt to have a representative to submit your requirements you need to have a notarized Special Power of Attorney (SPA) as well as valid IDs of you (the owner) and the authorized representative. If you will submit the requirements personally, you may disregard this section.

Part 4 - Business Information

Field 35. Primary/Secondary Industries - under Primary Trade/Business Name add the name of the business you registered under DTI. Under Regulatory Body on the same row, write DTI.

Part 5 - Authority to Print

You can fill out these fields after you receive the Sample OR together with the Printer’s Certificate of Accreditation and Certificate of Registration from your printer.

Lastly, sign the Declaration section with your signature over printed name.

Proof of Address

If the business location is rented, you will need to submit a photocopy of the Contract of Lease. If the business location is owned you need the Certificate of Land Title.

TAKE NOTE! The notarized date of the contract of lease should be within the month when you’ll be registering your business. If the business is online, and you are renting where you reside, you have to renew your Contract of Lease. In my case I submitted a Contract of Lease that was notarized for more than a year, and I had to pay 1,500php worth of accumulated penalties for every month since the notarized date up to the date when I submitted my application for registration.

Valid IDs

Any government-issued IDs are acceptable — Birth Certificate, passport, driver’s license, community tax certificate, UMID, TIN ID; and that shows your name, address, and birthdate. In case the address is not visible on the ID, any proof of residence or business address will do as a supporting document in addition to the ID.

Application for Authority to Print Receipts and Invoices

After filling out two copies of the BIR Form 0605: Payment Form, and having the required documents from your printer: the Sample Official Receipt, the printer’s Certificate of Accreditation and Certificate of Registration, you can then proceed to fill out two copies of BIR Form 1906: Authority to Print Receipts and Invoices, and two copies of BIR Form 2000: Monthly Documentary Stamp Declaration/Return.

Registration of Book Accounts

You can now proceed to purchasing the required books for the registration of your book accounts. As mentioned from the list of requirements above, these are the following:

- One (1) General Ledger (or columnar ledger if no general ledger is available)

- One (1) General Journal (or 2-column columnar if no journal is available)

- Two (2) Columnar (8-14 columns)

You can purchase these from bookstores and just ask them to look them for you as they are mixed together with other books and might be confusing to non-accountants (like me). 🙈

BIR Form 1905: Application for Registration Information Update/Correction/Cancellation

After acquiring these books, you can then proceed to filling out two copies of BIR Form 1905: Application for Registration Information Update/Correction/Cancellation and fill out the Books of Accounts section (1) Taxpayer Information on the first page and section (10) Books of Accounts on the third page and sign the Declaration section.

Final Part:

Credits: Illustration by Natasha Remarchuk from Icons8