Now that you are equipped with the knowledge about the requirements and how to fill out the forms required for BIR Business Registration, you can now proceed to pay the fees and submit all the forms and documents you’ve accomplished to BIR.

This is part 6 of The Ultimate Guide to Starting a Business in the Philippines series.

Table of Contents:

- Additional Fees

- BIR Form 2303: Certificate of Registration

- Official Receipt

- Due Dates of Filing

- Automated Tax Filing

Additional Fees

As an added preparation, bring at least 2,000php in addition to the 530php registration fee as taxpayer profiles vary, and we wouldn’t know if you might encounter a different penalty for whatever unforeseen reason.

BIR Form 2303: Certificate of Registration

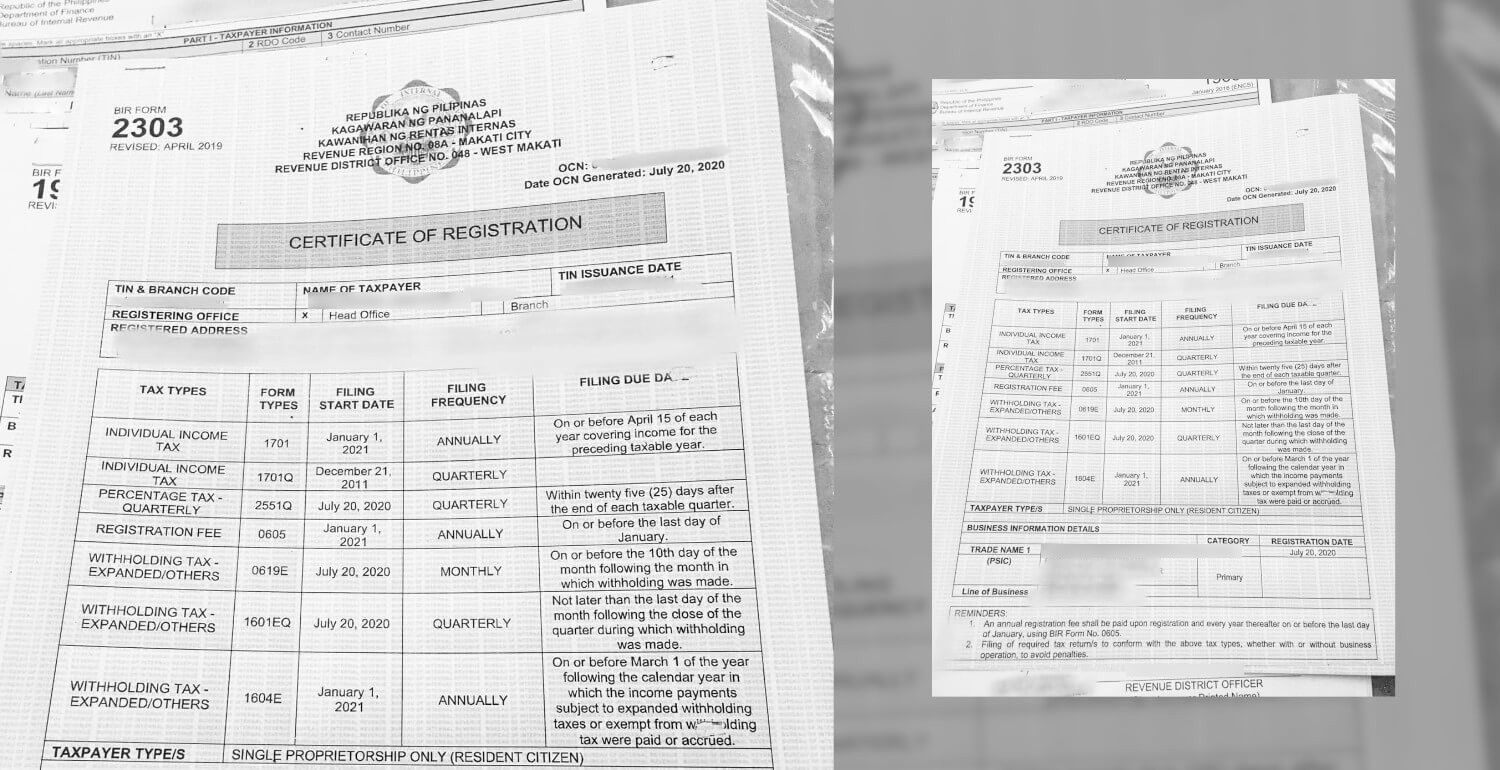

After submitting your requirements, you have to wait 5-7 business days before your BIR Form 2303: Certificate of Registration can be picked up. The duration might vary depending on the Regional District Office so it’s helpful to ask them for the date.

Here’s what a COR looks like:

Official Receipt

Once you’ve already received your Certification of Registration, they will also provide the Authority to Print that you will then hand over to your printer, so they could proceed printing your official receipts.

Due Dates

Be aware of the filing due dates from your COR. Regardless if you have income for the month or none, you have to file these declarations. The penalty for a month undeclared ranges from 1,000php to 1,500php. You can file in person to your RDO, via BIR’s eFiling and Payment System online, or using a licensed tax service provider like Taxumo.

Automated Tax Filing for Zero Income

If you just want to register the business for now and don’t want to hire an accountant or bookkeeper right away, you can have an automated filing for zero income for only ₱200 per month at Taxumo. If you join using my referral code GIANFAYE you’ll get a 5% discount. 😉

That’s it! If you encounter anything on your business registration that might be helpful to others reading this article feel free to share them on the comments section below. ↓

Credits:

- Illustration by Natasha Remarchuk from Icons8